The casino industry in the United States had a phenomenal year in 2023, raking in record revenues and contributing significantly to state and local coffers, ensuring economic development. From the glitzy casinos of Las Vegas is home to a growing number of tribal gaming establishments, and Americans clearly love to gamble. And with the rise of online options and crypto casinos, the industry shows no signs of slowing down. But how much did all this gambling translate into tax revenue for the

government? Let’s dive into the numbers.

A Surge in Gaming Revenue

According to the American Gaming Association (AGA), commercial gaming revenue in the US reached a staggering $66.5 billion in 2023. This marks the third consecutive year of record-breaking revenue, demonstrating the industry’s resilience and continued growth. This surge in revenue naturally translates into higher tax collections for both state and local

governments.

Breaking Down the Numbers

The AGA reports that commercial casinos generated $13.49 billion in direct gaming tax

revenue in 2023. This represents a 15.3% increase compared to 2021 and highlights the

significant contribution the industry makes to public funds. It’s important to remember that

this figure only accounts for taxes directly linked to gaming activities, such as taxes on slot

machines, table games, and sports betting. It doesn’t include the billions of dollars casinos

pay in other taxes, like property taxes, sales taxes, and income taxes for their employees.

Where Does the Money Go?

The tax revenue generated by casinos is used to fund a variety of public services, depending

on the state and local regulations. Some common uses include:

- Education: Funding for schools, colleges, and universities.

- Infrastructure: Improving roads, bridges, and public transportation.

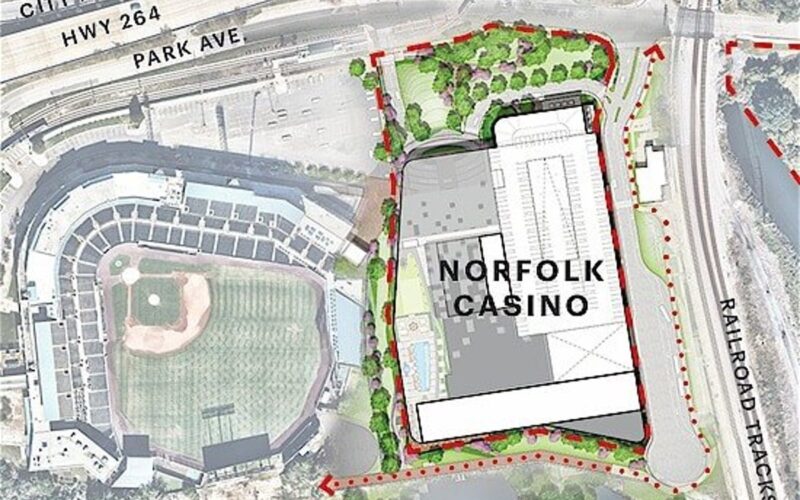

- Economic development: Supporting initiatives that create jobs and boost the local economy.

- Public safety: Funding for police and fire departments.

- Tourism: Promoting tourism and attracting visitors to the area.

The Rise of Online Casinos

While brick-and-mortar casinos still dominate the industry, online casinos are rapidly gaining

popularity. This trend is likely to continue as technology advances and more states legalize

online gambling. Online casinos offer convenience and accessibility, allowing players to

enjoy their favorite games from the comfort of their homes. This growth in online gambling

presents both opportunities and challenges for tax collection.

Challenges and Opportunities

One challenge is ensuring that online casinos are properly regulated and taxed. States need

to develop effective frameworks to track online gambling revenue and collect the appropriate

taxes. However, the rise of online casinos also presents an opportunity to generate even

more tax revenue. As the market expands, so does the potential tax base.

Looking Ahead

The casino industry is expected to continue its growth trajectory in the coming years. With

new casinos opening and the expansion of online gambling, tax revenues are likely to

remain strong. This is good news for state and local governments, as it provides a valuable

funding source for essential public services. Similar to the revenue made from weed taxes in 2022, the rise in online gambling will continue to be a source of federal income.

In Conclusion

The casino industry plays a significant role in the US economy, generating billions of dollars

in tax revenue each year. This revenue is vital for funding public services and supporting

local communities. As the industry continues to evolve, it’s crucial to have effective

regulations in place to ensure that casinos contribute their fair share to the public good.